It is one of the most challenging time to when it is your turn to make VAT payments in UAE. No one likes to pay yet we all have to pay this is our basic liablity. Some may see VAT payments as necessary for supporting the government’s budget and providing public services, while others may view it as an additional tax burden. However you might see it, you have to pay your Taxes on time.

The VAT payment in the new Emara Tax portal has changed effective 1st December 2022. Payment procedures are complicated now unlike earlier. If the payment is not done correctly the amount bounces back which may result in fine.

We have tried to put down the steps by which you can pay your VAT on time. If you are trying to make online payment through bank, please remember the following.

1. Make sure that your bank allows you to pay vat (There are banks which do not have this facility).

2. When you make the payment, please put the exact amount (to the fills).

3. Make sure to put the reference number (explained below) in the invoice section (wherever the bank provides so) or remarks column.

4. After you made the payment, please make sure the same is reflected in the tax portal.

5. Please don’t wait till the last date, as you may have last minute surprises.

6. If you are planning to pay by Credit/ Debit Card, please note that FTA charges little less than 1% (unlike earlier 2.5%).

Mastering VAT Payments in UAE can be the most daunting task, here is Your Ultimate Step-by-Step Guide to help you pay your taxes on time.

Please check below steps for payments via bank transfers or Credit/Debit Card.

Guide to Pay taxes online:

Step 1 – Go to Emara Tax vat portal and log in. https://eservices.tax.gov.ae/#/Logon

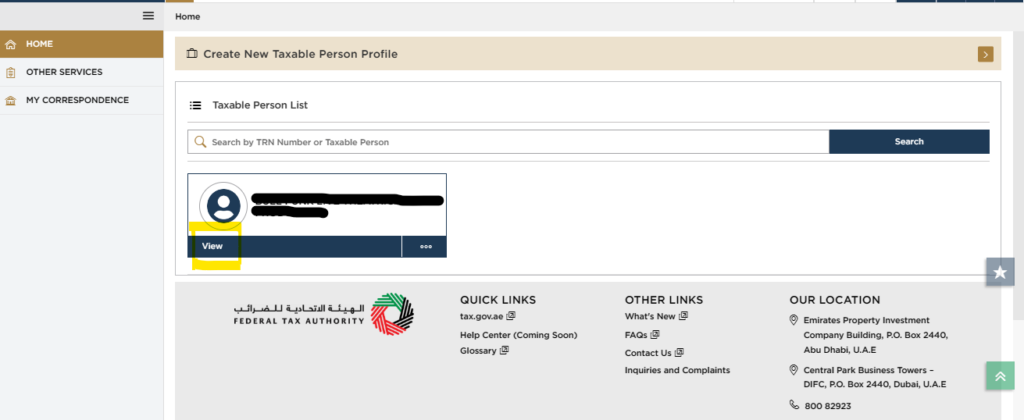

Step 2 – Click view under the Taxable person list

After you have logged on click on View.

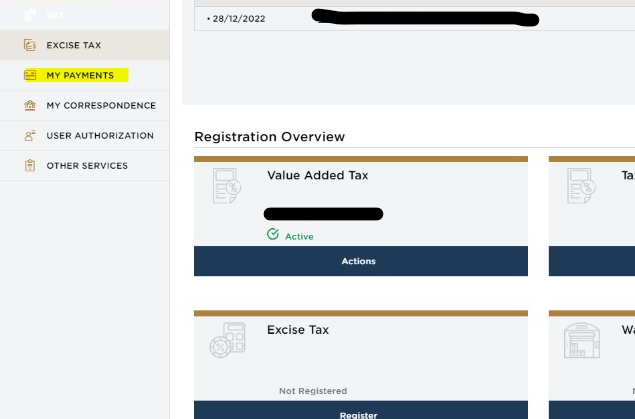

Step 3 – Go to my payments

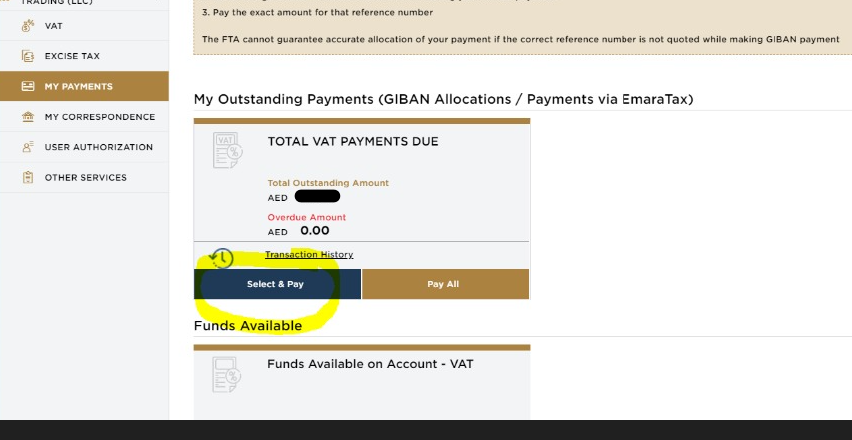

Step 4 – Then go to “Select and Pay”

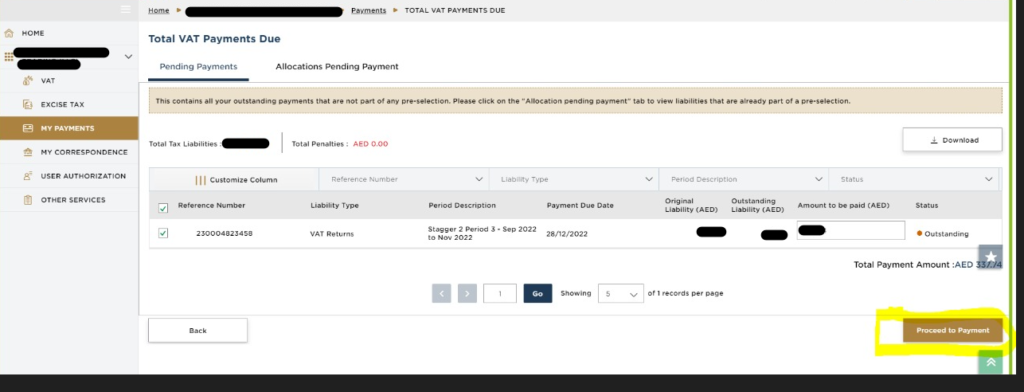

Step 5 – Click the check box left to the reference no and click “proceed to payment“.

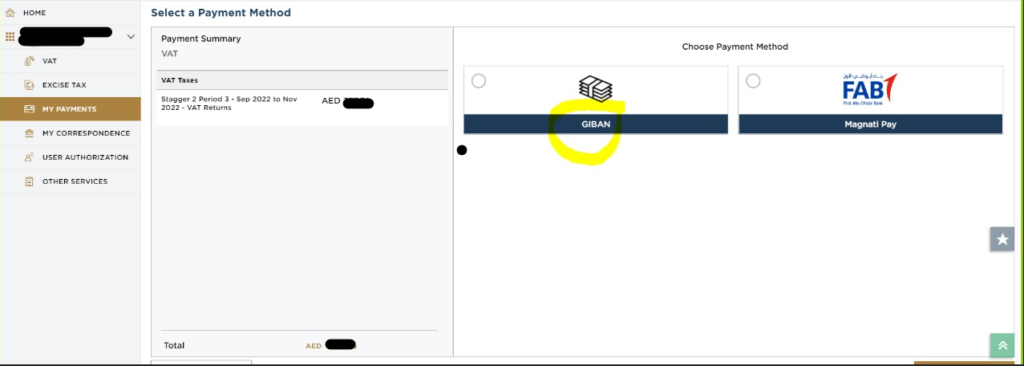

Step 6 – Then choose the GIBAN option for Bank Transfer.

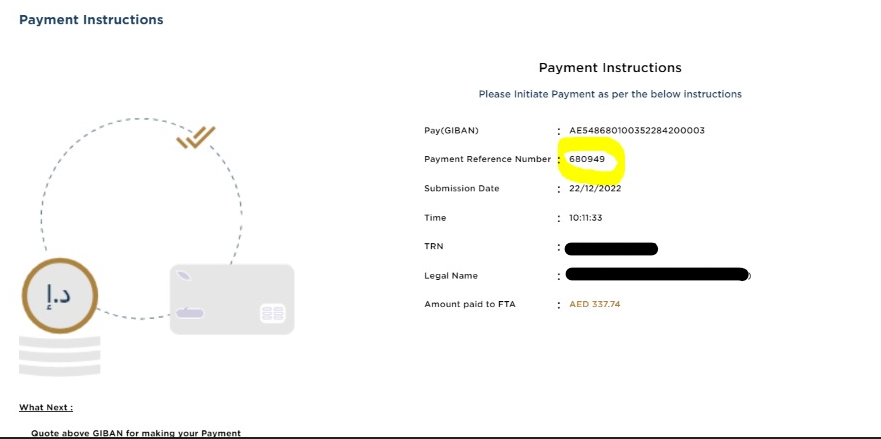

Step 7 – Then you’ll get the following payment instructions. When you initiate the bank transfer make sure to put the 6 digit reference no in the notes. Also put the exact amount as shown in the “Amount paid to FTA”. You GIBAN No is mentioned in the ‘Pay (GIBAN).

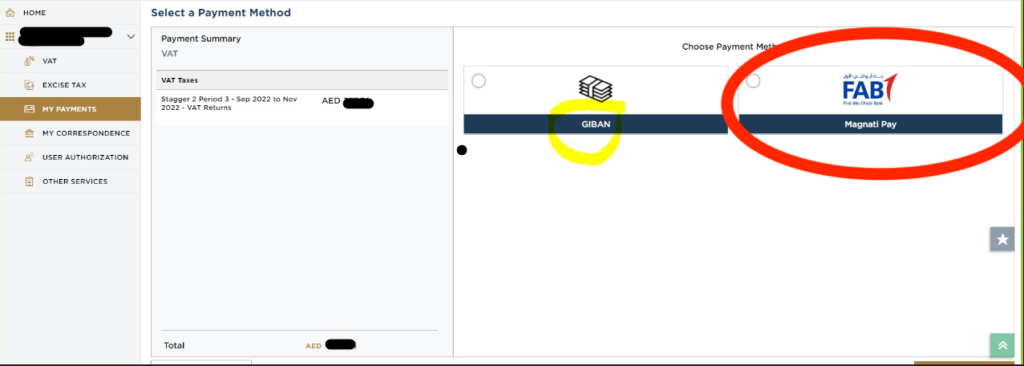

Step 8: In case of Credit or Debit Card option, please use Magnati as below:

If you need any additional assistance for the above process, you can contact us. We would be happy to assist you regarding the same. You can contact us at sudeshna@beyondnumbers.ae. To know more about our services click the below link : https://beyondnumbers.ae/service/