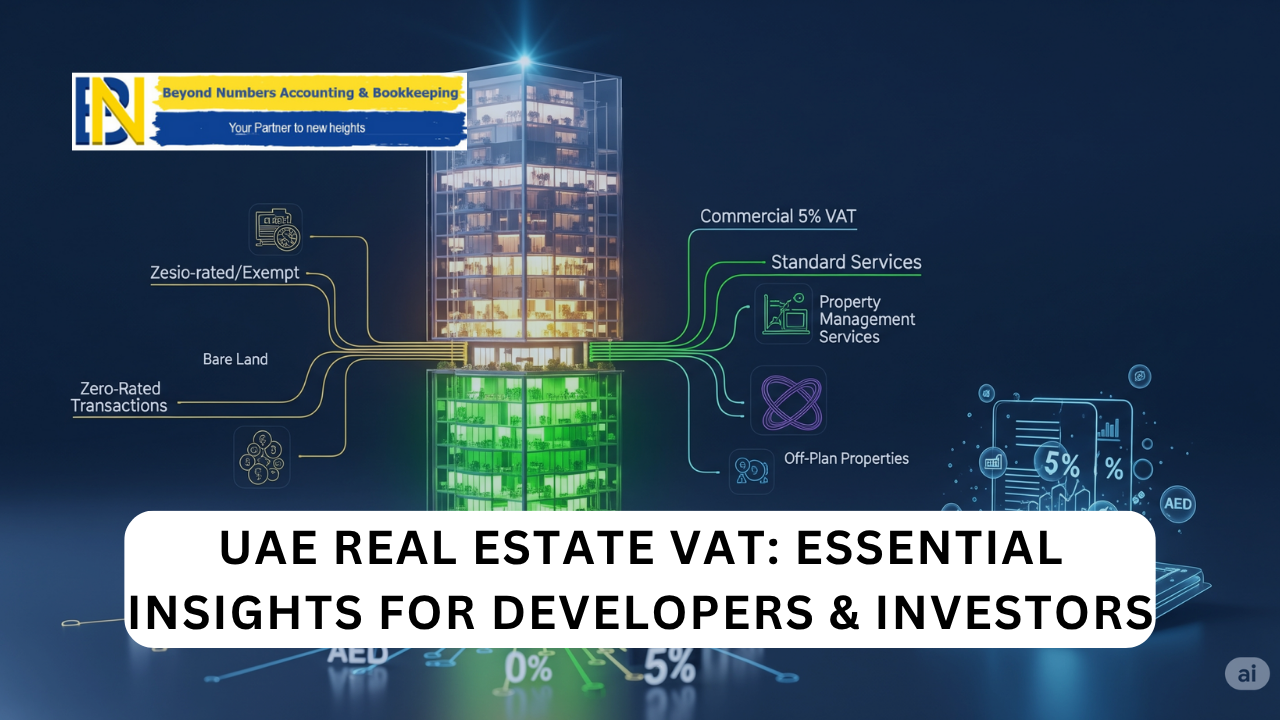

Guide to UAE Real Estate VAT: Essential Insights for Developers & Investors

A comprehensive guide to UAE real estate VAT, offering essential insights for developers and investors. Understand the distinctions between residential and commercial properties, including zero-rated, exempt, and standard 5% VAT applications. Learn about VAT treatment for bare land, off-plan properties, mixed-use developments, and real estate-related services. Discover crucial details on input tax recovery, VAT registration thresholds, accurate invoicing, and meticulous record-keeping to ensure compliance, optimize cash flow, and mitigate liabilities in the UAE’s dynamic real estate market.